KYC: KYC(કેવાયસી)નું ફુલ ફોર્મ શું છે? સરળ રીતે સમજો KYC વિશે.

Today let us know about KYC (કેવાયસી) in which you will know the full name of KYC and complete information about KYC .. !!

Guys ... you must have heard the name KYC(કેવાયસી) and you will be using Paytm, Google Pay, PhonePe all these apps in your mobile. In all these applications the KYC (કેવાયસી) process is required to verify the account.

So let us know about KYC today in which you will find out what is the full form of KYC? And other information about KYC.

What is the full form of KYC?

KYC's full name is "Know Your Customer".

If we define KYC i.e. ... (Know Your Customer) in simple Gujarati, it will be said that complete information about the customer.

Everyone needs to do KYC (Know Your Customer).

Every bank does KYC of its customer. KYC is always mentioned in banking and financial sector operations. Banks especially for the identification of their customers.

Understand KYC easily

KYC is used in banking and financial transactions. You have to do KYC when you open a new bank account. The bank needs this process for your identification when you do KYC. Also, if you want to invest in a mutual fund, take a bank locker or withdraw the PF amount of an old company, you have to do KYC.

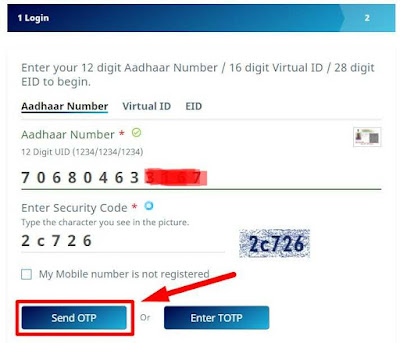

Apart from all these, when you buy a SIM card, you check the Aadhaar card for your identity, this process is also called KYC. KYC form can also be filled online ...

Along with KYC you need your ID proof which includes Aadhar Card, PAN Card, Water ID Card etc.

Processing KYC does not constitute an identity and does not constitute a fraud in your financial transactions as the bank knows your identity through KYC and only then completes the processing of your transaction.

The KYC process was started by the Government of India in 2002. Then in the year 2004 it was announced that all types of banks in India would have to complete this KYC process. In 2005, the RBI declared that all banks must comply with the KYC process.

What are the benefits of KYC?

KYC enhances transparency between the bank and the customer.

If the KYC process of the applicant is completed, it therefore reduces the possibility of forgery or fraud. So do not hesitate to submit documents with KYC.

Since the bank has all the information of the customer, the bank has the right to take action if the customer commits fraud.

You do not have to go to the bank to make money transactions, you can quickly transfer money from one account to another using mobile applications like Google Pay, Paytm, PhonePe.

It is also easy for you to purchase the product if KYC is processed for online money transactions.

The customer's work is also completed quickly and satisfactorily through the KYC process to avail the government scheme.

KYC saves a lot of customer time.

Where is the KYC process required?

KYC is required in bank, locker, loan, insurance, government works, fixed deposit, post office, PF process etc.

⇛ ગુજરાતીમાં અહિયાંથી વાંચો 👇.👉 સંપૂર્ણ જાણકારી ગુજરાતીમાં.

What documents are required for KYC process?

Certificate of your identity for the KYC process (any of the following list runs)

- Aadhar Card

- Pan Card

- Driving license

- Ration card

- Water ID card

Friends, I hope you have learned a little more about KYC today. Please share it with your friends.

You can join our WhatsApp group to get updates of every new post so you can get updates of new posts.